Life and Disability Benefits

Life Insurance Benefits – Required

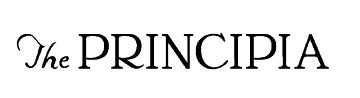

Required basic employee life insurance

Principia and you share equally in the cost of your basic employee life insurance, which is equal to two times your annual base salary (rounded to the next higher $1,000) to a maximum of $550,000 in basic life, and an additional two times your annual base salary in accidental death insurance.

Your coverage is reduced to 65% of your life insurance benefits on January 1 of the year following your 70th birthday.

Life & AD&D Benefit Coverage

Required basic dependent life insurance

Principia provides you with basic life coverage for your family: $2,000 for your spouse and each of your children, up to age 26.

Life Insurance Cost of Coverage

| Monthly Premium | |

|---|---|

| Monthly Premium | |

| Life & AD&D | $.078 per $1,000 of coverage |

Imputed income tax

Basic employee life insurance

If half of your basic employee life insurance benefit Exceeds $50,000, you’ll be taxed on the value of the coverage greater than $50,000, and the value will be added to your W-2 earnings. The value is determined using the table to the right (published by the IRS).

Basic dependent life insurance

Tax on the value of basic dependent life insurance (for each covered dependent) will be added to your W-2 earnings. This value

is determined using the table to the right (published by the IRS).

Imputed income tax example

A 40-year-old employee makes $100,000 and is covered by $200,000 of basic employee life insurance. Principia pays for half of the benefit, so imputed income tax is calculated based on the $100,000 that Principia provides, and only then on the amount that exceeds $50,000. For a 40-year-old, the cost of $1,000 of insurance for one month is $.10. Refer to the calculation table to the right.

| Taxable amount Each Month for $1,000 of Insurance by Age Group* (IRS Table 1) | ||

|---|---|---|

|

Taxable amount Each Month for $1,000 of Insurance by Age Group* (IRS Table 1) |

||

| Age | Cost | |

| <25 | $0.05 | |

| 25 through 29 | $0.06 | |

| 30 through 34 | $0.08 | |

| 35 through 39 | $0.09 | |

| 40 through 44 | $0.10 | |

| 45 through 49 | $0.15 | |

| 50 through 54 | $0.23 | |

| 55 through 59 | $0.43 | |

| 60 through 64 | $0.66 | |

| 65 through 69 | $1.27 | |

| Over 70 | $2.06 | |

| Taxable Income Calculation | ||

|---|---|---|

| Taxable Income Calculation | ||

| 1. Taxable coverage ($100,000 – $50,000) | $50,000.00 | |

| 2. Annual cost per $1,000

(12 months x $.10) |

$1.20 | |

| 3. Included in employee’s taxable income ($1.20 x 50) |

$60.00 | |

Common Life Insurance Terms:

Accidental Death Insurance (AD&D): Generally an add-on to a regular life insurance policy, it is only paid if the death of the insured occurs as the result of an accident.

Age Reductions: Most insurance policies reduce your life insurance benefit as you age.

Beneficiary: The person or party named by the owner of a life insurance policy to receive the policy benefit.

Contingent beneficiary: The party designated to receive proceeds of a life insurance policy following the insured’s death if the primary beneficiary predeceased the insured.

Conversion: If you ever leave employment, you may be able to convert the group policy into an individually owned life insurance policy.

Coverage Amount: Value of life insurance.

Portable: If you ever leave employment, you may be able to port the life insurance coverage to a new plan.

Premiums: Amount paid to the insurance company to buy a policy and keep it in force.