Flexible Spending Accounts

We offer two FSAs — Healthcare (both Traditional and HSA-Compatible) and Dependent Care. These accounts with Inspira Financial allow you to set aside pre-tax dollars to cover qualified expenses you would normally pay out of your pocket with post-tax dollars. See below for account descriptions and maximum contribution amounts.

How an FSA works:

- Choose a specific amount of money to contribute each pay period, pre-tax, to one or both accounts during the year.

- The amount is automatically deducted from your pay at the same level each pay period.

- As you incur eligible expenses, you may use your flexible spending debit card to pay at the point of service, submit the appropriate paperwork to be reimbursed by the plan, or pay your provider directly from your FSA account.

Healthcare FSA

A Healthcare FSA is a smart, simple way to save money on taxes while keeping you and your family healthy and protected.

Traditional FSA

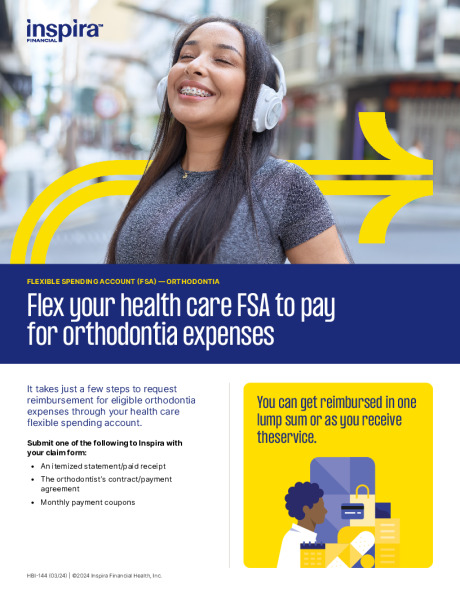

The traditional FSA is an option for people who are not contributing to a Health Savings Account. With a traditional FSA, you can use your funds to pay for eligible medical, dental, and vision expenses. Learn the rules and more here.

HSA-compatible Healthcare FSA

If you enroll in a Principia HSA medical plan and you elect a Healthcare FSA, you’ll be enrolled in an HSA-Compatible Healthcare FSA (also known as a Limited-Purpose FSA), which allows you to spend your pretax Healthcare FSA election on dental and vision expenses only. After you meet your medical deductible, Inspira can approve the use of your Healthcare FSA funds for medical expenses. Here’s a helpful breakdown of an HSA versus an FSA.

For additional details on an HSA-compatible FSA, watch this short video.

Using your funds

- Use the Inspira debit card to pay for eligible expenses

- Pay out of pocket and get reimbursed

- Save receipts (required for reimbursement)

- Download the InspiraFinancial app for easy account management

Limits and Deadlines

2026 annual contribution limits

• Maximum: $3,400

• Minimum: $100

Use it or Lose it

Spend your election by March 15 and submit claims by March 31 of the following year. Anything not claimed by the deadline is forfeited.

Use our benefit decision- making tool called ALEX to help estimate your tax savings when you contribute to a Flexible Spending Account.

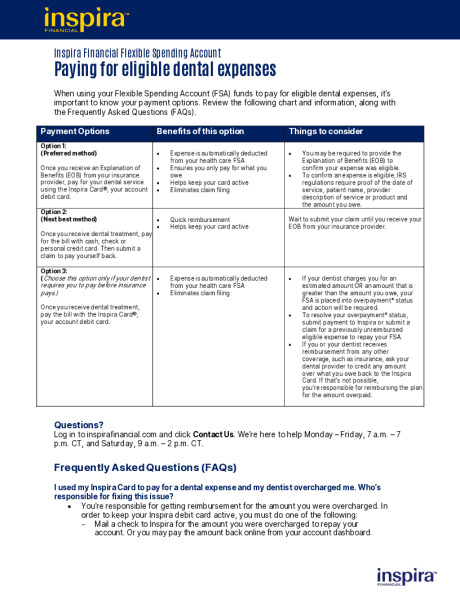

Dependent Care FSA

The Dependent Care FSA lets you pay for dependent care, including various childcare and elder care services, on a pretax basis.

Eligible dependents

Eligible dependents include the following:

- Your dependent children under age 13 who can be claimed as dependents by you on your federal income tax return

- Your spouse and other dependents of any age who satisfy the following three criteria:

- Lives with you at least eight hours a day

- Is physically or mentally unable to care for himself or herself

- Can be claimed as a dependent on your federal income tax return

Eligible expenses

- Daycare and after-school care

- Summer day camps (overnight camps not eligible)

- Tuition from infant through preschool (excludes private school tuition for Kindergarten and up)

Your care provider must claim the payment they receive from you as income on their tax form.

Click here to learn more.

Deadlines and limits

2026 maximum contribution

- Maximum: $7,500

- Minimum: $100

Use it or Lose it

Spend your election by March 15 and submit claims by March 31 of the following year.

Anything not claimed by the deadline is forfeited.