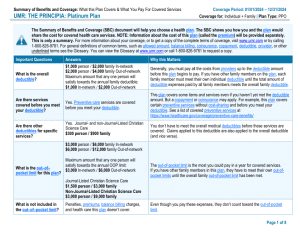

Which Health Plan is Right?

Evaluate Your Needs. Consider your prior health care usage and select plans and options that fit your lifestyle and needs.

- Do you take regular prescription medications?

- Are you anticipating surgery?

- Did you experience a qualifying life event this year?

- Review your current plans to ensure you have the coverage you need.

Review this benefits website and spend time with ALEX to learn about your plan options.

A little bit of planning will help you select the best plans, coverage levels, and financial programs for your unique situation.

Health Benefits

Health Plans – UMR

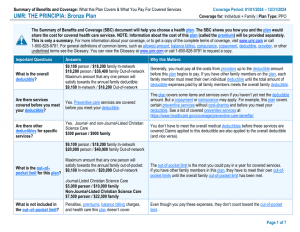

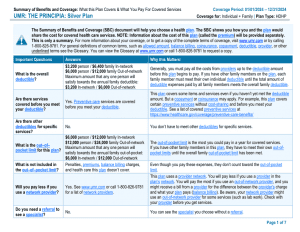

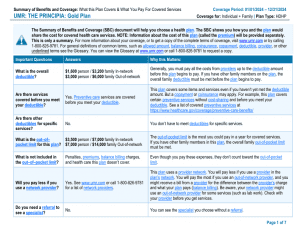

Principia offers four health plans through UMR, which provides a robust national network of doctors, hospitals and facilities. All of your claims will be administered by UMR.

Find an in-network provider on www.umr.com using the UnitedHealthcare Choice Plus Network.

All plans include comprehensive health and prescription coverage, including Christian Science care.

| Bronze | Silver (HSA) | Gold (HSA) | Platinum | |||||

|---|---|---|---|---|---|---|---|---|

| Annual Limits | ||||||||

|

Calendar Year Deductible* Individual / Family |

$9,100 / $18,200 | $3,200 / $6,400 | $1,600 / $3,200 | $1,000 / $2,000 | ||||

|

Maximum out-of-pocket* Individual / Family |

$9,100 / $18,200 | $6,000 / $12,000 | $3,500 / $7,000 | $3,000 / $6,000 | ||||

|

Christian Science CareInd/Fam Deductible Ind/Fam Max Out-of-Pocket |

$300 / $900 $5,000 / $10,000 |

Same as medical | Same as medical | $300 / $900 $1,500 / $3,000 | ||||

|

Coinsurance Your cost, after deductible |

0%-medical 20%-CS |

20% | 20% | 20% | ||||

|

Principia HSA Contribution Individual / Family |

None | $200 / $400 | $400 / $800 | None | ||||

| Coverage | ||||||||

| Preventive Care | No cost | No cost | No cost | No cost | ||||

|

Healthcare Telehealth thru Teladoc Primary Care doctor Specialist Urgent Care Emergency Room |

Deductible, then coinsurance | Deductible, then coinsurance | Deductible, then coinsurance | $10 copay $25 copay $50 copay $100 copay $350 copay | ||||

| Hospital Stay | Deductible, then coinsurance | Deductible, then coinsurance | Deductible, then coinsurance | Deductible, then coinsurance | ||||

| Maternity Care | Deductible, then coinsurance | Deductible, then coinsurance (plus $1,500 Principia HSA Contribution) | Deductible, then coinsurance (plus $1,500 Principia HSA Contribution) | Deductible, then coinsurance | ||||

| Prescriptions | ||||||||

| Tier 1 (Generic) Tier 2 (Brand) Tier 3 (Non-preferred) Tier 4 (Specialty) |

Deductible applies, once deductible is met, then copay applies | Deductible applies, once deductible is met, then copay applies | Deductible applies, once deductible is met, then copay applies | $10 $35 $60 $75 | ||||

| Monthly Premiums | ||||||||

| Employee | $30 | $60 | $90 | $150 | ||||

| Employee + Child(ren) | $60 | $120 | $180 | $300 | ||||

| Employee + Spouse | $90 | $180 | $270 | $450 | ||||

| Family | $120 | $240 | $360 | $600 | ||||

*Out-of-network deductibles and out-of-pocket maximums are nearly DOUBLE the in-network equivalents, and you’re responsible for a higher level of coinsurance when you go out-of-network. Visit an in-network provider to save significantly on costs.

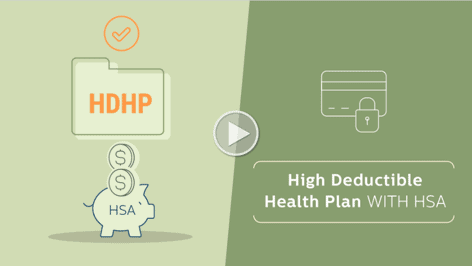

How The Plans Work

| Key Functions | Bronze | Silver (HSA) | Gold (HSA) | Platinum |

|---|---|---|---|---|

| Christian Science CarePractitioners, nurses and nursing facilities | Subject to a lower CS deductible ($300/$900) and out-of-pocket max ($1,500/$3,000); CS and medical deductibles are integrated | Integrated CS and medical deductibles are the same | Integrated CS and medical deductibles are the same | Subject to a lower CS deductible ($300/$900) and out-of-pocket max ($1,500/$3,000); CS and medical deductibles are integrated |

| Pay for care with pre-tax dollars | FSA | HSA and Limited Purpose FSA | HSA and Limited Purpose FSA | FSA |

| Principia contribution to Health Savings Account | No | Yes | Yes | No |

| Individual deductible applies if you cover your family | Yes, all individual costs will count toward the family deductible and out-of-pocket max, but will be limited to the individual deductible and out-of-pocket max. | Yes, all individual costs will count toward the family deductible and out-of-pocket max, but will be limited to the individual deductible and out-of-pocket max. | No, the family deductible must be met, either by one individual, or by a combination of family members, before the plan begins to pay. The same rule applies to the out-of-pocket max. | Yes, all individual costs will count toward the family deductible and out-of-pocket max, but will be limited to the individual deductible and out-of-pocket max. |

| What will I pay if I go to a doctor when I’m sick? | You’ll pay 100% of costs until you meet your deductible. Your claims will then be covered in full by the plan. | You’ll pay 100% until you meet your deductible. Then, you’ll pay 20% until you meet your out-of-pocket max. Your claims will then be covered in full by the plan. | You’ll pay 100% until you meet your deductible. Then, you’ll pay 20% until you meet your out-of-pocket max. Your claims will then be covered in full by the plan. | You’ll pay a copay (amount varies based on type of doctor seen). |

Did you know? The Christian Science deductibles and medical deductibles are integrated on all the plans, so as you incur covered expenses, they’ll be applied to both your medical and your Christian Science deductible.